Contents

What is a Sole trader?

A sole trader is an individual who runs their own business and is self-employed. After you’ve paid your taxes, you can keep all of your company’s profits. You are individually liable for any losses your company incurs. You must also observe specific guidelines when operating and naming your company.

Even if you haven’t told HM Revenue and Customs that you are self-employed, this indicates that you are (HMRC).

Features of Sole trader

- Take charge of your own business and be accountable for its success or failure.

- have multiple consumers at once

- the freedom to work where, when, and how you want

- you to have the option of paying for the services of others to assist you or complete the work for you.

- give the essential tools for your work

- be sure to charge a definite amount for your services.

How to start your business as a sole trader/requirement in London?

If any of the following apply, you must register as a sole trader.

- Between 6 April 2021 and 5 April 2022, you made more than £1,000 through self-employment.

- To claim Tax-Free Childcare, you must demonstrate that you are self-employed.

- you wish to make voluntary Class 2 National Insurance contributions in order to qualify for benefits

To register as a sole trader, you must inform HMRC that you will be paying tax through Self Assessment. Every year, you must file a tax return.

What are the responsibilities?

- Must keep business records and records of expenses.

- send a Self Assessment tax return every year

- and pay Class 2 and Class 4 National Insurance on your winnings. For budgeting purposes, utilize HMRC’s calculator.

- A National Insurance number is required if you’re relocating to London to start a business.

Whom to contact for guidance?

- You can contact 0300 200 3310 (textphone 0300 200 3319).

- Monday to Friday: 8 am to 6 pm

- Outside UK: +44 135 535 9022

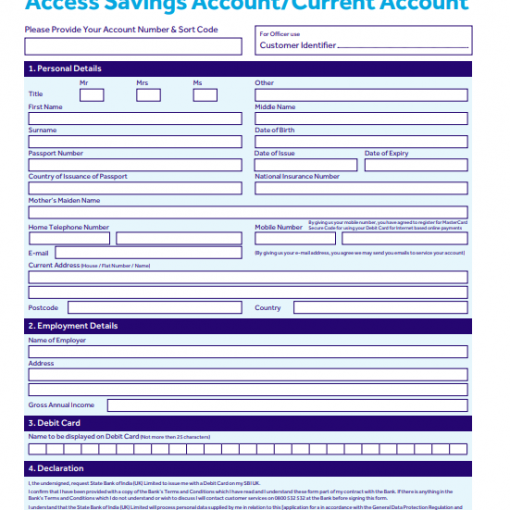

Documents required

- Must be a UK citizen

- Hold a valid passport

- Terms and conditions of the business.

- Consultancy agreement

- Must have a business name.

What is the cost?

- There are no registration charges.