Contents

London Customs: Know the Customs in London

London Customs is where goods coming into or leaving the country are checked and taxed. It helps regulate trade and ensure safety and compliance with laws. It plays an important role in trade oversight and revenue collection, contributing to the country’s economic stability and security. This article provides detailed information on London customs.

What are London customs?

London Customs, historically known as HM Customs, was the national customs service of England and later of Great Britain and the United Kingdom until its merger with the Department of Excise in 1909. This office played an important role in managing the collection, assessment, and administration of customs duties on imported and exported goods for over a thousand years. Operating mainly in coastal ports, customs officers were responsible for revenue collection, cargo examination, duty assessment, and preventing smuggling. Additionally, they were involved in various maritime law enforcement activities such as salvage regulation, quarantine, immigration, and trade oversight. The Custom House in Lower Thames Street served as the headquarters for HM Customs and housed officials responsible for national administration and oversight. The merger of HM Customs with the Excise Department in 1909 led to the creation of HM Customs and Excise, which later evolved into HM Revenue and Customs.

Their primary goal is to ensure the security, safety, and well-being of the people of London while promoting trade and commerce. London Customs is a major part of London’s economy. They help to attract businesses and investors by making it easy to import and export goods. They also protect the people of London by stopping dangerous or illegal goods from entering the country.

History of London Customs:

The history of London Customs dates back over a thousand years, with customs duties recorded in Britain since the Middle Ages. By the start of the 19th century, HM Customs had custom houses in 75 ports in England and Wales, each managed by collectors responsible for revenue collection and cargo examination. Customs officers were not only involved in revenue collection but also had responsibilities in maritime law enforcement, including salvage regulation, quarantine, immigration control, fisheries oversight, trade embargoes, and statistics collection. The Port of London played a significant role in customs operations due to its status as Britain’s largest port. The medieval Custom House was rebuilt in 1559 and underwent modifications over the centuries to adapt to changing trade practices and revenue sources. The merger of HM Customs with the Excise Department in 1909 led to the creation of HM Customs and Excise, which later evolved into HM Revenue and Customs.

London Customs’ Services:

London Customs’ services involve declaring goods imported into the UK from various countries, following specific procedures set by the Taxation (Cross Border Trade) Act 2020 and other regulations.

- Importers must declare goods to Customs and assign them to approved treatments or uses.

- Special arrangements exist for declaring goods at import, such as bulk consignment procedures and low-value bulk imports.

- Importers must correctly declare goods, pay applicable taxes and duties, and ensure regulatory compliance for certain goods, such as food.

- VAT (value-added tax) and customs duty are typically applicable upon import, with exceptions for certain goods like low-value items or those in free circulation within the EU.

Common items that are prohibited by London Customs:

Common items prohibited by London customs include controlled drugs like cocaine and heroin and offensive weapons such as flick knives. Additionally, items like rough diamonds and personal imports of meat and dairy products from most non-EU countries are also restricted or banned. It is important to be aware of these restrictions to avoid issues when passing through customs in London.

Process of importing goods into the UK:

When importing goods into the UK, you need to declare them to HM Revenue & Customs using a customs declaration form. Goods can be brought into the UK through various means, like road, rail, air, sea, post, or courier services. It is important to pay any taxes or customs charges owed before the goods can be delivered to you.

To import goods into the UK, follow these steps outlined by the UK government:

- Check if you are moving goods permanently to England, Wales, Scotland, or Northern Ireland from a country outside the UK or EU.

- Get an EORI number starting with GB, necessary licenses, and ensure the sender can export the goods.

- Most businesses use customs agents or brokers to handle customs declarations and the transportation of goods.

- You must determine the commodity code for your goods, declare their value, and check if you need a license or certificate for specific items.

- Submit import declarations and manage VAT and duty payments. HMRC will provide payment details after submission.

- Certain goods require inspection before entering the UK. In that case, arrange for a goods inspection.

Role of customs officers in London:

- Customs officers in the UK play an important role in maintaining border security by preventing the importation of illegal goods.

- Their responsibilities include searching luggage, vehicles, and travelers, checking customs documents for validity, questioning individuals with illegal items, preparing reports, and making arrests when necessary

- Customs officers also collect taxes and customs duties on goods that have been declared to ensure compliance with regulations.

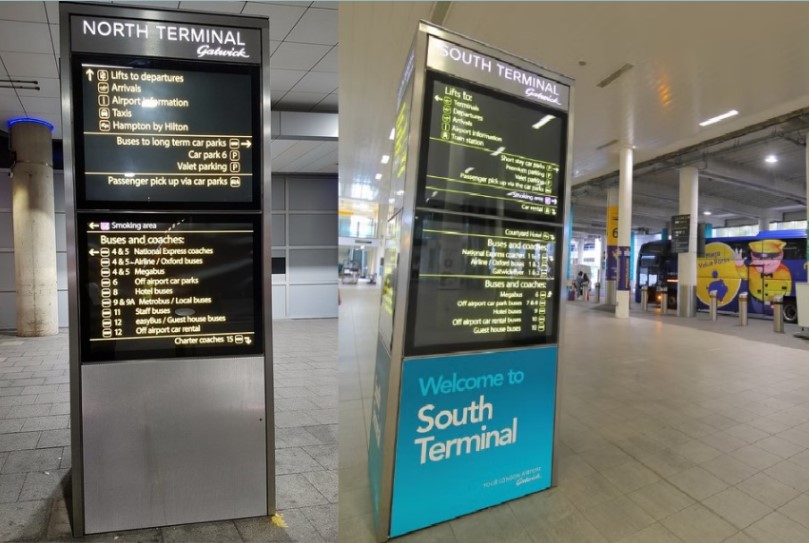

- They work in locations like airports and seaports, collaborating with other agencies such as the police and the Home Office to enforce laws and protect the country from smuggling and illegal trade.

- Additionally, senior customs officers manage operational teams, coordinate services, and enforce trade and customs laws.

London Customs’ Services:

London customs services involve passengers declaring goods upon arrival. Passengers from the EU must choose between the green channel (nothing to declare) or the red channel (goods to declare) at Heathrow Airport. The UK Customs in England, Scotland, and Wales have red and green channels for declarations, with specific rules on goods allowances and restrictions. The customs process includes declaring personal belongings, cash, or commercial goods at the red channel or red point phone upon arrival. London’s customs aim to protect the UK from harmful goods and tax evasion.

Consequences of violating trade laws:

Violating trade laws enforced by HM Customs can lead to significant consequences. Civil penalties, such as financial penalties up to $2,500 per offense or violation, are imposed for irregularities related to customs rules, import duties, and VAT. These penalties aim to follow customs laws and regulations. If you fail to follow, HMRC may impose civil penalty actions like warning letters or financial penalties. However, if there is a valid reason for breaking the law, individuals may not be liable for penalties. Import bans due to forced labor violations can also have major consequences and can lead to geopolitical tensions and countermeasures by affected countries. Travelers must declare any amount of money exceeding £10,000 or its equivalent in other currencies to customs. Additionally, violating trade laws may lead to challenges under global trade rules and possible disputes under the World Trade Organization (WTO).

London Customs is a major organization that plays an important role in the country’s economy and its global trade. London customs have low import tariffs, keeping goods costs down for consumers. Customs officers help maintain border security by preventing the importation of illegal goods, safeguarding the nation’s interests. By providing efficient and secure services, it helps to promote trade and protect the country’s borders.

Check the List of Customs offices in London city and other cities in UK address, phone number, email, hours, import/export details